Definition of retained earnings

As the name suggests, retained earnings represents income that was retained (i.e., kept, accumulated) by the company. Retained earnings represent one of the stockholders’ equity accounts: that is, retained earnings are reported on the balance sheet – as well as the statement of stockholders’ equity.If retained earnings represent retained income (or loss, if negative), why it is not reported on the income statement? Remember, the income statement (also called, statement of earnings) shows the results of operations of a particular accounting entity for a particular period of time (e.g., this fiscal year) while the balance sheet (also called, statement of financial position) shows the financial condition of the entity as of a particular date. As retained earnings represent accumulated income as of a particular date, it makes sense to report retained earnings on the balance sheet.

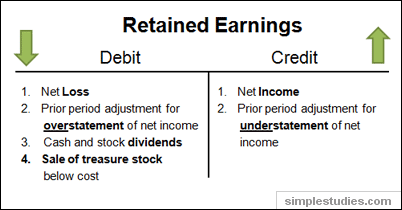

Importantly, retained earnings link the balance sheet to the income statement: net income increases retained earnings while net loss decreases retained earnings. Retained earnings are affected by net income (loss), cash and stock dividends, prior period adjustments for overstatement or understatement of net income, and disposal of treasury stock below cost (see Illustration below):

The normal balance in retained earnings is credit: that is, retained earnings increase when credited and decrease when debited. A debit balance in the retained earnings account is called a deficit.

In some jurisdictions, incorporation laws prohibit companies from paying dividends when there is a deficit balance in the retained earnings account. There are accounting procedures that can be used to eliminate the deficit. For example, a company might be able to reclassify the deficit (e.g., decrease additional paid-in capital and increase retained earnings up to the zero balance) or eliminate the deficit through an accounting reorganization (e.g., write-up an asset or write-down a liability to its fair market value).

In general, changes in retained earnings can be reported in:

- separate statement of retained earnings (see the following example)

- statement of stockholders’ equity

- combined income and retained earnings statement

Example of calculating retained earnings

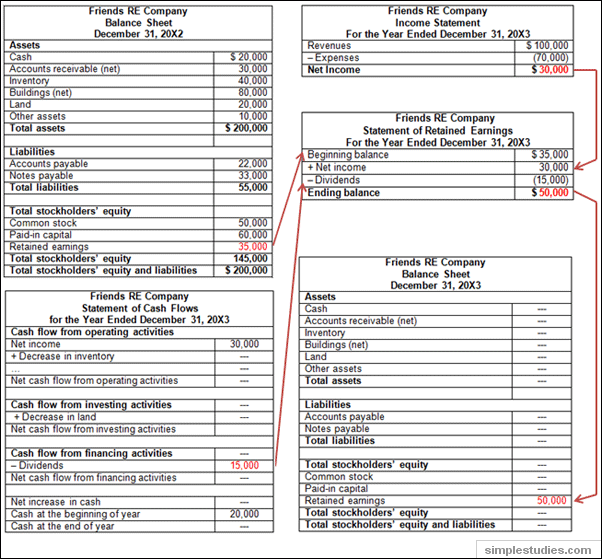

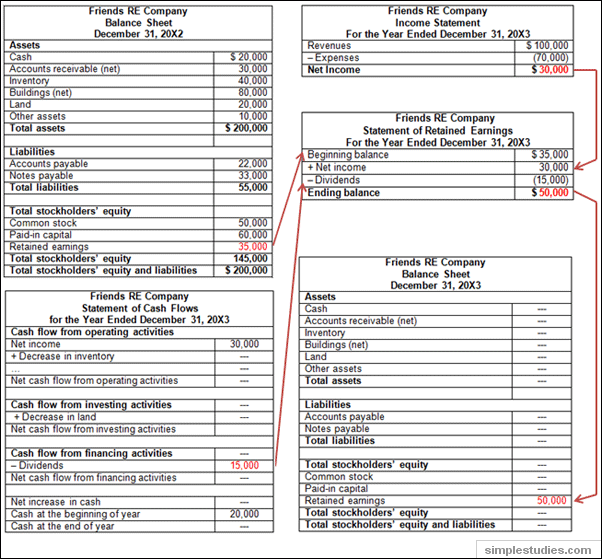

Let’s look at a simple example. Assume that Friends RE Company (a fictitious entity) had the following balance sheet as of December 31, 20X2:

Friends RE Company

Balance Sheet December 31, 20X2 |

|

| Assets | |

| Cash |

$ 20,000

|

| Accounts receivable (net) |

30,000

|

| Inventory |

40,000

|

| Buildings (net) |

80,000

|

| Land |

20,000

|

| Other assets |

10,000

|

| Total assets |

$ 200,000

|

| Liabilities | |

| Accounts payable |

22,000

|

| Notes payable |

33,000

|

| Total liabilities |

55,000

|

| Total stockholders’ equity | |

| Common stock |

50,000

|

| Paid-in capital |

60,000

|

| Retained earnings |

35,000

|

| Total stockholders’ equity |

145,000

|

| Total stockholders’ equity and liabilities |

$ 200,000

|

In 20X3, the company’s revenues and expenses (including tax) were $100,000 and $70,000, respectively (see below). The company paid $15,000 in cash dividends.

Friends RE Company

Income Statement For the Year Ended December 31, 20X3 |

|

| Revenues |

$ 100,000

|

| – Expenses |

(70,000)

|

| Net Income |

$ 30,000

|

From the balance sheet above, we know that that 20X3 beginning balance

in retained earnings was $35,000 (i.e., it’s the same as the ending balance in

20X2). To calculate the 20X3 ending balance in retained earnings, we need to

add the net income earned in 20X3 and deduct the cash dividends paid in 20X3.

To see the links between different financial statements, see the illustration below:

What if Friends RE Company made a mistake in applying an accounting principle in 20X2 but only discovered the error in 20X3? Let’s assume that in 20X2 the company understated the cost of goods sold account by $10,000 (net of tax). As the result, the company overstated both the net income and retained earnings accounts by $10,000 in 20X2. The company discovered the error before issuing the 20X3 financial statements.

Such an error can be corrected by adjusting the beginning balance in the retained earnings account (i.e., prior period adjustment). Friends RE Company would report the following statement of retained earnings in 20X3:

Friends RE Company

Statement of Retained Earnings For the Year Ended December 31, 20X3 |

|

| Beginning balance |

$ 35,000

|

| + Net income |

30,000

|

| – Dividends |

(15,000)

|

| Ending balance |

$ 50,000

|

To see the links between different financial statements, see the illustration below:

What if Friends RE Company made a mistake in applying an accounting principle in 20X2 but only discovered the error in 20X3? Let’s assume that in 20X2 the company understated the cost of goods sold account by $10,000 (net of tax). As the result, the company overstated both the net income and retained earnings accounts by $10,000 in 20X2. The company discovered the error before issuing the 20X3 financial statements.

Such an error can be corrected by adjusting the beginning balance in the retained earnings account (i.e., prior period adjustment). Friends RE Company would report the following statement of retained earnings in 20X3:

Friends RE Company

Statement of Retained Earnings For the Year Ended December 31, 20X3 |

|

| Beginning balance, as previously stated |

$ 35,000

|

| Prior period adjustment – error correction |

(10,000)

|

| Beginning balance, as restated |

25,000

|

| + Net income |

30,000

|

| – Dividends |

(15,000)

|

| Ending balance |

$ 40,000

|

This post is good.it helps me to understand more about the retained earning. keep up the good workstatement of retained earnings

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteCheck out Statement of retained earnings

ReplyDelete